Managing SEO Campaigns in Declining Industries

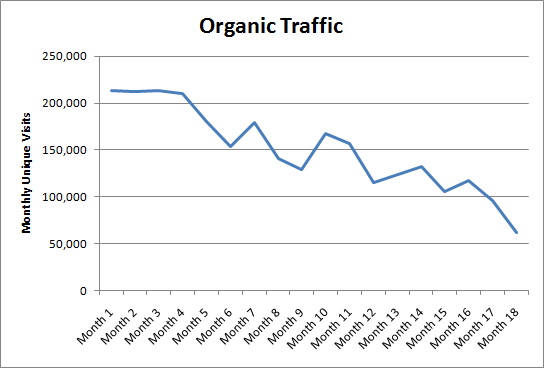

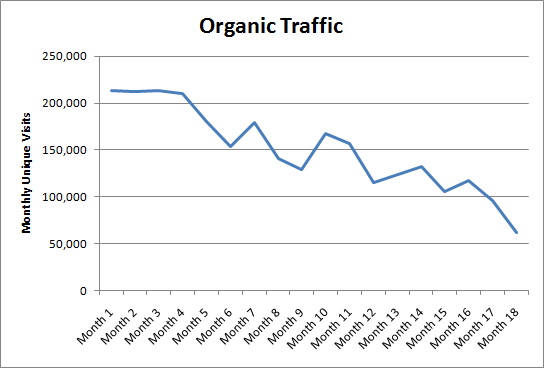

This is a graph of organic traffic for a theoretical site - they might be in an industry such as print advertising, construction equipment or VHS rental. The decline in traffic is pronounced and serious.

A critical distinction when looking at a graph like this is whether the site's performance is increasingly worse than the competitors, or whether the whole industry is in decline. In this post I want to recommend some metrics that can be tracked to benchmark your site against competitors (independent of market behaviour) and to check the health of the industry. I'll then make suggestions for finding opportunities to slow or reverse the trend of dropping traffic.

For the benefit of the time-poor, the post ends with a three point checklist / summary.

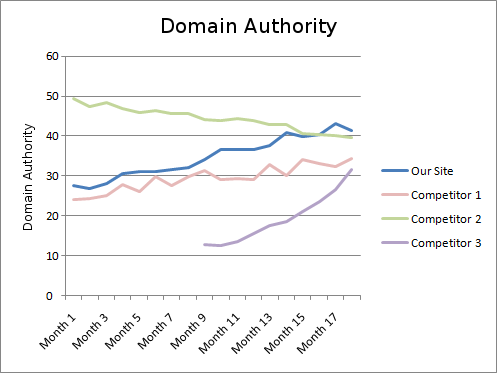

This chart tracks the Site Authority of the target domain (and some competitors) through time.

To date, trying to chart Linkscape metrics has been a bit misleading: the rapid increase in the reach of Linkscape and modifications of the tool's algorithms have meant that month-by-month reporting of a site's Authority wasn't always a fair comparison. However, Nick tells me that the team are currently putting effort into tackling the challenge of tracking this data. Though you'll have more confidence in drawing a trend chart such as this one soon, I'd still recommend collecting numbers right now to get a snapshot of where your site is amongst the competition.

Obviously, this assessment of site strength is query independent; differences in site architecture, on-page term targeting and the anchor text of external links will have a significant effect on each site's performance and number of keywords.

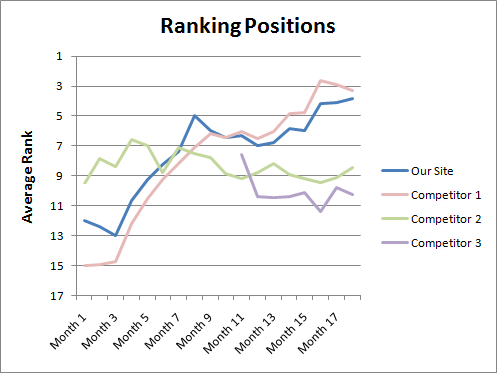

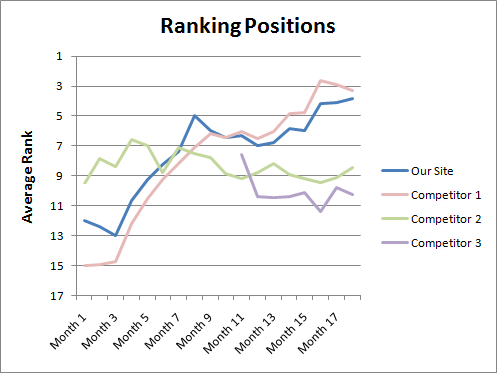

In many ways, the next graph address this. The line for the target site is an 'average ranking position' - I'd recommend creating this by taking around twenty non-branded, representative keyphrases (eg: ten which you're specifically targeting and ten which send a significant amount of traffic) and finding the mean of the site's ranking for each phrase.

The competitor lines should be calculated by finding the mean ranking position of that site, for each of these keywords where the site ranks in the top 20. (We do this so that the mean isn't artificially dragged down by keyphrases which the site isn't trying to compete for, and where it ranks very poorly.)

Even a single month's data points on these two graphs will provide a snapshot of your site's position amongst the industry's other players. Tracking the data each month will demonstrate how your standing has changed, and can directly show the impact of your SEO work - both on-site and off-site.

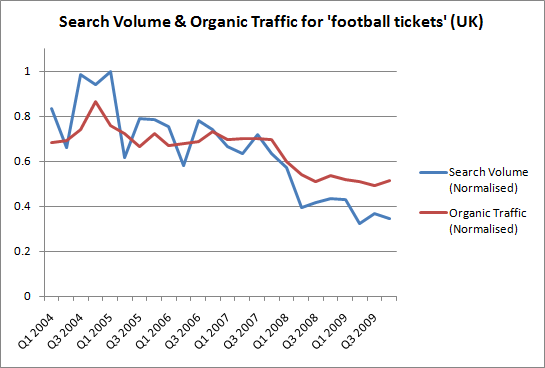

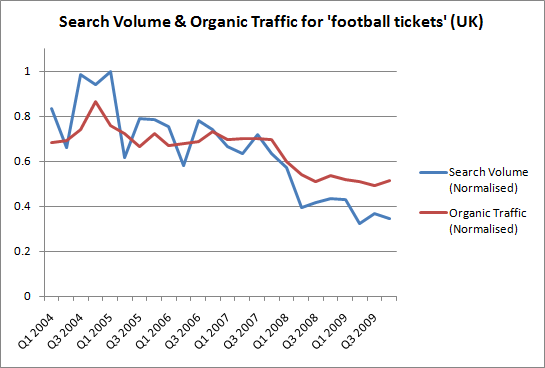

If you don't have historic ranking data, but suspect that your industry is in decline, you should compare search volume trends to organic traffic sent by some specific terms. In the example below, the site sees a decline in traffic for the single keyphrase 'football tickets' but comparing this to the search volume for the term shows that the site's performance has actually improved - they are increasing their share of that traffic.

If the industry really is declining and search volumes for all the typically valuable phrases are unlikely to return, then there can be a serious consideration about even continuing to operate in the market. If your core business was VHS rental, consider offering Blu-Ray; if you rank well for house and holiday insurance but are suffering from the decline in these markets then consider adding pet insurance - a steady / growing market. (Check out this Google Insights data for UK insurance markets.)

Of course, these are extreme examples - and if you're in these particular industries then you shouldn't need a blog post to make these suggestions - but they remind us that there are some markets where a time comes to look for business from elsewhere.

If you last did keyword research 12 or 18 months ago, user behaviour may have changed significantly - even for people looking for exactly the same product. Whilst the metrics mentioned above may bring you to the gloomy conclusion that search volume in your industry is substantially down, it's possible to overlook the fact that there's simply been a change in searcher behaviour.

Examples of such changes that have happened in different geographic regions:

A critical distinction when looking at a graph like this is whether the site's performance is increasingly worse than the competitors, or whether the whole industry is in decline. In this post I want to recommend some metrics that can be tracked to benchmark your site against competitors (independent of market behaviour) and to check the health of the industry. I'll then make suggestions for finding opportunities to slow or reverse the trend of dropping traffic.

For the benefit of the time-poor, the post ends with a three point checklist / summary.

Competitors and Benchmarking

There are a couple of different metrics you can use track, which will demonstrate the more direct outputs of your SEO work, and expose your performance amongst competitors.This chart tracks the Site Authority of the target domain (and some competitors) through time.

To date, trying to chart Linkscape metrics has been a bit misleading: the rapid increase in the reach of Linkscape and modifications of the tool's algorithms have meant that month-by-month reporting of a site's Authority wasn't always a fair comparison. However, Nick tells me that the team are currently putting effort into tackling the challenge of tracking this data. Though you'll have more confidence in drawing a trend chart such as this one soon, I'd still recommend collecting numbers right now to get a snapshot of where your site is amongst the competition.

Obviously, this assessment of site strength is query independent; differences in site architecture, on-page term targeting and the anchor text of external links will have a significant effect on each site's performance and number of keywords.

In many ways, the next graph address this. The line for the target site is an 'average ranking position' - I'd recommend creating this by taking around twenty non-branded, representative keyphrases (eg: ten which you're specifically targeting and ten which send a significant amount of traffic) and finding the mean of the site's ranking for each phrase.

The competitor lines should be calculated by finding the mean ranking position of that site, for each of these keywords where the site ranks in the top 20. (We do this so that the mean isn't artificially dragged down by keyphrases which the site isn't trying to compete for, and where it ranks very poorly.)

Even a single month's data points on these two graphs will provide a snapshot of your site's position amongst the industry's other players. Tracking the data each month will demonstrate how your standing has changed, and can directly show the impact of your SEO work - both on-site and off-site.

Industry Assessment

If you have been collecting ranking data in the past, then it can be useful to identify a term for which you've had a relatively static ranking over the last year or so. If your traffic from this term has declined over the same period then this provides a useful example of how market behaviour outside of your control is having an effect on the business.If you don't have historic ranking data, but suspect that your industry is in decline, you should compare search volume trends to organic traffic sent by some specific terms. In the example below, the site sees a decline in traffic for the single keyphrase 'football tickets' but comparing this to the search volume for the term shows that the site's performance has actually improved - they are increasing their share of that traffic.

If the industry really is declining and search volumes for all the typically valuable phrases are unlikely to return, then there can be a serious consideration about even continuing to operate in the market. If your core business was VHS rental, consider offering Blu-Ray; if you rank well for house and holiday insurance but are suffering from the decline in these markets then consider adding pet insurance - a steady / growing market. (Check out this Google Insights data for UK insurance markets.)

Of course, these are extreme examples - and if you're in these particular industries then you shouldn't need a blog post to make these suggestions - but they remind us that there are some markets where a time comes to look for business from elsewhere.

Actions

As we did in the graph above, you must begin by looking at the organic traffic trend for keyphrases individually. A lot of information is lost when data is aggregated (such as in total organic traffic.) Go back and look at your highest volume keyphrases from a year or two ago, and compare these to your current highest volume keyphrases, by charting the monthly volume of traffic they sent over that period. It may quickly become clear that whilst your keyword portfolio has been dragged down by some dogs, there are some stars (or problem children) that are contributing a great deal to the overall traffic.If you last did keyword research 12 or 18 months ago, user behaviour may have changed significantly - even for people looking for exactly the same product. Whilst the metrics mentioned above may bring you to the gloomy conclusion that search volume in your industry is substantially down, it's possible to overlook the fact that there's simply been a change in searcher behaviour.

Examples of such changes that have happened in different geographic regions:

- searchers are using more direct queries ('cinema' & 'film tickets' are steady or down, 'film times' is way up)

- searchers are moving from long tail to head terms ('internet marketing' & 'website promotion' are declining but 'SEO' and 'SEM' are up)

- searchers are moving from head to long tail terms ('currency exchange' is down but specific terms such as 'dollars to pounds' are up)

I promised you a checklist.

Please take away these three points:- If your organic traffic is down, either for particular keywords or as a whole, be clear whether this is because your site is under-performing, or because the search volume for a keyword / in an industry is descending.

- Benchmark yourself against competitors by regularly recording the Authority and/or rankings position for relevant keyphrases of your site and theirs

- Revisit your keyword research - a year is a long time on the internet, particularly given the current state of flux that so many industries are experiencing.

![Convince Your Boss to Send You to MozCon 2025 [Plus Bonus Letter Template]](https://moz.rankious.com/_moz/images/blog/banners/eee4a4a8-d4aa-457e-80b1-0ffa186b88ff_2025-06-27-174747_coli.png?w=580&h=196&auto=compress%2Cformat&fit=crop&dm=1751046467&s=454333def17ba9d472d3d98b6786741e)

![How To Drive More Conversions With Fewer Clicks [MozCon 2025 Speaker Series]](https://moz.rankious.com/_moz/images/blog/banners/Mozcon2025_SpeakerBlogHeader_1180x400_RebeccaJackson_London.png?w=580&h=196&auto=compress%2Cformat&fit=crop&dm=1750097440&s=296c25041fd58804005c686dfd07b9d1)

Comments

Please keep your comments TAGFEE by following the community etiquette

Comments are closed. Got a burning question? Head to our Q&A section to start a new conversation.