Moz's $18 Million Venture Financing: Our Story, Metrics and Future

The author's views are entirely their own (excluding the unlikely event of hypnosis) and may not always reflect the views of Moz.

Today is a good day. Whether you're a Mozzer, a fan of what we've built, a Seattle-startup supporter or even tangentially involved in the field of web marketing, there's reason to celebrate. After 5 years of organic growth (from our initial funding in 2007) and two tough, failed attempts at financing (in 2009 and 2011), I'm excited to announce that SEOmoz has raised $18 million in venture capital from Foundry Group and Ignition Partners. Brad Feld from Foundry and Moz's COO, Sarah Bird will be joining the board as Gillian Muessig steps down to pursue new goals. Oh, and that chip on my shoulder about VCs is probably gonna shrink a bit. :-)

You can find the official meme-based press release here. But, as our core values dictate, this post is going to be lengthy and extremely transparent about our progress to date, the financing process, our new investor, and the road ahead. I've broken these into the sections below:

- The Past 5 years of Metrics & Growth

- Our 2012 Funding Process & Deck

- Brad Feld & Foundry

- Company Ownership and Notes on my Cofounder's Departure

- Plans for the Months and Years Ahead

SEOmoz's Past 5 Years of Metrics & Growth

In February of 2007, we launched a collection of tools and resources for SEOs, hoping it would help bolster our traditional consulting practice. By the end of that year, it was responsible for nearly half our total revenue and Seattle's Ignition Partners and Curious Office, invested $1.1mm to help see the vision of software for professional SEOs grow. Two years later, we dropped consulting entirely to focus 100% of our efforts on PRO membership.

Since then, our subscription product has grown tremendously and achieved exceptional traction. We've iterated massively on the orignal product with launches of the Linkscape web index in 2008, Open Site Explorer and our Pro Web App in 2010, the Mozbar for Firefox and Chrome, SERPs Analysis and more recently, too, with additions like Social Tracking, Branded Segmentation, Google Analytics integration, Universal SERPs tracking, and our new, much larger, Mozscape index. And our customers seem to have appreciated it:

*As of April 2012, we're significantly ahead of budget for 2012, w/ a March revenue run rate of ~$19mm

As you can see, our small Series A has carried us a long way. Out of necessity, we've been re-investing nearly all of the money we've made in the last half-decade back into growing the company. Below, you can see the progress of our subscription model over the last 6 months.

_

*December's lower free trials (due to the holidays) means slower January growth

I've talked a number of times about our subscription metrics here at SEOmoz, but given this fundraising, I know there may be additional interest and scrutiny, so I'll try to describe them with a bit more depth:

- On an average weekday, ~150 marketers take a free trial

- Approximately 56% of those 150 free trials will convert into paid memberships

- Of those, ~40% cancel their membership in the first 3 paying months

- The remaining 60% (~50 out of our 150) keep their PRO subscription 13+ months on average (meaning the monthly cancellation rate is ~2.5%)

- Approximately half of those (~25) retain PRO membership for 18+ months

- Note: historically we've counted upgrades/downgrades, billing changes and some other dumb stuff in "churn" which likely inflates those figures.

For an enterprise SaaS business, these metrics are fairly mediocre (well, the churn metrics anyway, the acquisition numbers would be phenomenal), but thankfully, we're not the typical enterprise model. Because we have very low costs for customer acquisition (we acquire ~85% of our customers using inbound marketing rather than paid channels), and very low COGS (no account management, sales people, or services costs), our model scales very nicely. You can see more detail about this in our funding slide deck, embedded in the next section.

Traffic's been growing at a somewhat shocking pace, too. In the first 122 days of the year, SEOmoz + OpenSiteExplorer had 6.85 million visits:

Our traffic from every source has been increasing dramatically. In comparison, the 122-day period from April 3rd - July 30th, 2011 had 4.46 million visits, a growth rate of 54%. Search engines have been sending more traffic, our email marketing efforts are getting better, social media sources are up dramatically, and referring links + branded/direct is up, too. The only traffic source that's remained relatively stable is RSS, which we suspect is due to more and more people replacing their RSS reader with socially-based referrals and apps.

Looking at Moz in 2012, it would appear that we've got a healthy, growing business, but as you can see from the growth chart above, we'd predicted that our last few years of doubling subscription revenue would slow. This is largely due to capital constraints on the business. We couldn't make the technology, infrastructure, people or marketing investments we knew were needed to accelerate. That's precisely why, at our early February board meeting, we decided that despite our setbacks the previous summer, it was time to hit the road seeking venture investment for a third time.

Our 2012 Funding Process & Deck

Our board of directors meets quarterly to discuss the key issues facing the company and review the progress made in the prior three months. At our February meeting, each of our executive team members - Jamie from Marketing, Adam from Product, Sarah from Operations and Anthony from Engineering - expressed the sentiment that their teams could benefit from additional capital and that the time was right for a raise. Kelly Smith (of Curious Office, an observer on our board) and Michelle Goldberg (who represents Ingition) agreed.

Unfortunately, that meant getting my weary, jaded head back into the funding world, something I'd been dreading since our last financing fell apart just after we signed a term sheet in August 2011. We strongly considered but ultimately rejected hiring bankers to help us run the deal process, and this was in large part due to my personal issues of confidence. It's hard to describe that feeling now, but I truly believed and feared that we'd once again spend months on road, pitching investors, and end in June or July with nothing to show for it again.

Much of February was spent contacting investors, colleagues and entrepreneurs we knew and asking for help with introductions, positioning and the creation and review of a funding slide deck. You can see a modified version of that deck below:

Some of those calls and connections led to early interest from some big names in the later-stage industry (VCs who typically put $15-50mm into companies at Series C, D and above). Unfortunately, these started out with a familiar pattern - a call expressing interest, a request for data, upon receipt of that data, a deeper request for more data, repeat ad nauseum. We were just settling in for the tough reality of a long slog to reach that first offer we could leverage to start a process when I got on the phone with Brad.

Brad Feld and Foundry Group

Nearly every entrepreneur and person connected to the startup field knows of Brad Feld and Foundry Group through the exceptional reputation they've built. Brad's been named the most respected VC in the business, makes hilarious music parody videos, funds dozens of successful companies, co-founded Techstars, is a two-time entrepreneur himself, runs inhumanly long distances and sponsors lots of public bathrooms. He's a very awesome, very weird and very Mozzy guy. I liked Ben Huh's recent post about him best:

I've been fortunate to have him on our board and he's helped us even before we took funding. In start-up lingo, he's my number one value add, even on a board studded with greatly helpful and wickedly smart people.

The funny thing is, I would describe my interactions with Brad as slightly weird. Yup. Weird. Not in the creepy WTF? kind of way, but good, like whoa-I'm-being-transported-to-another-planet kinda way...

...He's unlike any VC I've ever met.

When we got on the phone, I knew that A) Foundry almost always does early-stage deals and B) They almost never put more than $10mm into a deal and C) They hadn't asked us for any preliminary information or a deck. Thus, I was fairly certain that this call was purely advice-driven, though I hoped it would potentially lead to some helpful introductions. But, when I started the call asking for help, Brad stopped me. He said Foundry was interested in potentially leading the round themselves. My heart skipped a few beats, and we got into a conversation.

How do I know Brad? Through three of the more unlikely sources imaginable: first, Brad + Seth had looked at SEOmoz briefly in our 2009 raise attempt, but, like a lot of others, passed at the time; second, through my blog post on failing to raise money (which Brad read and wrote about); and last, through my wife Geraldine, whose blog and tweets are apparently a topic of enjoyment between Brad and his wife Amy. Side note: Next time someone asks what Geraldine's blog monetization strategy is, I'm replying with "it already made $18mm, what more do you want?!" :-)

The Saturday morning after that phone call, Brad wrote a post entitled "Don't Be Gunshy Because You Dealt with BucketHeads the Last Time Around." The Moz team was already enamored with Brad and working hard to keep our excitement in check. That post made it harder, and then this email (sent later that evening) made it 10X harder still:

We sent in excess of 40 emails back and forth over the next 3 days. Included in that volley was an invitation to come to Boulder, Colorado to meet some of the companies he'd invested in, his partners at Foundry, and talk seriously about an investment. I also got to talk to T.A. McCann from Gist, Ben Huh from Cheezburger and Keith Smith from BigDoor, Brad's other investments in Seattle.

Interesting side note: Many investors we've talked to over the years have told us to "talk to their CEOs." I almost always take those introductions and get on the phone, but VCs may not realize either A) how honest CEOs are with each other or B) what their CEOs actually think of them. Due to these, I've often heard recommendations that damn with faint praise or point out a lot of good reasons not to get involved.

Brad's one of only a few exceptions. The reviews were unbelievably positive. So much so that it was hard to believe they were real. Each one brought up example after example of Brad putting the entrepreneur's interests ahead of his/Foundry's own, even when serious amounts of money were on the line. He may never have heard of TAGFEE until our conversations, but Brad lives those values in his personal and professional life with the same obsessesiveness that we do at Moz.

On Friday March 16th at butt'o'clock in the morning, Sarah and I boarded a flight to Denver, rented a car and drove to Boulder. We had lunch with the crew from GNIP, another of Foundry's investments. They are clearly awesome dudes - the kind we'd love to work with (and the restaurant they took us to had the impossibly-hard-to-find cult beer, Pliny the Younger, in stock). The pattern of Brad's investment in very cool people was becoming clear.

After lunch, we spent the afternoon meeting with the Foundry team. There's only 4 of them, because Brad doesn't believe in associates (I'll let him explain in a blog post at some point). Jason, Ryan, Seth and Brad were all surprisingly easy-going and their styles put at ease, too. It was a welcome change of pace from the usual hours spent in VC offices. After the meetings wrapped up, Brad took Sarah and I to dinner down the street at Oak.

Within minutes of sitting down, he said (rough, from my memory): "I talked to the guys before we left the office; everyone wants to do this deal. We're in."

Have you ever been in one of those situations where you want to get up, run around the room screaming and high-fiving everyone then order all the beer on the menu, but you have to stay cool and act like everything's normal? First world problem, indeed. :-)

Luckily, 30 minutes later, I got up to "use the bathroom" and texted my wife. She wrote back in classic Geraldine fashion:

Can I just say again how awesome it is being married to her?

We finished dinner with Brad, grabbed froyo next door, walked around Boulder's promenade and went back to our hotel. The following afternoon, he emailed over deal terms, all of which looked good except the pre-money valuation (initially $70mm - we'd hoped for higher). I emailed back that we loved everything about the deal, but were seeking a slightly higher pre-money. Brad said he'd check with his team and get back to us Monday. Despite my illness, I headed out to a bar for Moz's help team manager's (Aaron Wheeler) birthday. On St. Patrick's day.

The bar was packed to overflowing. I think I ordered a "whatever sounds good to you" from the bartender. The wall was lined with Montana-esque memorabilia and knick-knacks. Nearly a dozen mozzers crowded around a jam-packed booth. I looked down at my phone and saw this email from Brad.

Cue me freaking out, standing up from the booth, screaming and possibly attempting to buy everyone in the bar a round of drinks (thankfully, Geraldine grabbed me before I did so as it would have been a very expensive proposition). That round of jumping around and high-fiving everyone I missed out on in Boulder came back that night. I hope that after reading this post, you can let that same crazy smile spread across your face and lift a glass of your favorite beverage to help us toast. :-)

Looking back on this process with Foundry, the calendar is practically unbelievable. The time from the first phone call to an offer and agreement on deal terms was literally 8 days.

Now back in Seattle, we spoke to Michelle from Ignition and went to their Bellevue offices that Monday to pitch their partnership (using the deck you've seen above). The timeline was accelerated by an upcoming 2.5 week trip I had to Madrid, Munich, London, Boston, and San Francisco, but we made it work. When I left for Madrid on Wednesday, March 21st, we had already started the diligence process for our Series B.

On the middle leg of that long trip, in Munich for SMX, I had the chance to share some exciting news with friends at a downtown pub:

And somehow, Geraldine captured their reactions (and mine) with impeccable timing:

I think Will Critchlow's face in this photo perfectly sums up how all of us at Moz are feeling about this event.

This, of course, was followed by much drinking of German beer:

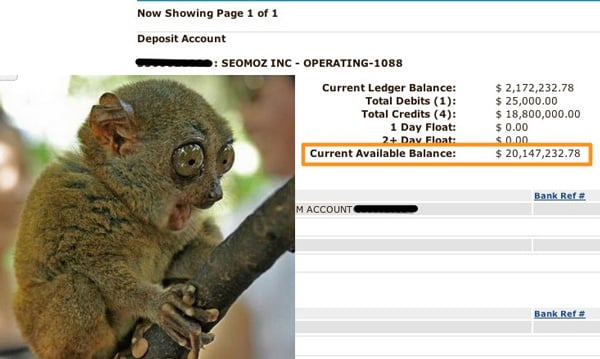

The round formally closed on Monday, April 23rd, when funds were wired to our account. Sarah sent around a nice screencap:

Prior to that, $2.17mm was our highest-ever account balance (we've been a bit more profitable than expected the last few months). I have to say that after years of aiming for investment to help us grow the business and, yes, to get some additional, external validation of our work, our model and our market, the transaction itself feels pretty good. But, perhaps stranger still, was a reflection on the funding I shared first with Geraldine, and then later in an email to Brad:

It sounds cheesy or overly-sentimental to say, but it's the truth. The money is going to help us do amazing things, and it's going to mean we can do a lot more of them faster and at greater scale than we could have on our own. But money can come from a lot of places. There's only one seat on our board for a new investor and I'm more certain than I've ever been about anything in my long tenure with this company that he and Foundry are the right match for our special brand of startup.

The Company Today and My Cofounder's New Path

For those interested in the VC world and the specific of the transaction, I'll try to provide some detail:

- The "pre-money" valuation of SEOmoz for this round was $75mm, which is ~4.1X our revenue run rate at the time of the deal.

- Ignition contributed $3mm to the round; Foundry put in $15mm

- The round carries mostly Series A terms, meaning a liquidation preference of 1X, but with no "participation" (this means in the event of a sale/liquidation of the company at less than their investment price, they get their money out first, but in a higher-than-investment price, they get only the percentage of the company they own and not the investment capital + stock returns, known as "participating preferred")

- Sarah Bird, our longtime COO, will be joining the board of directors

- Brad Feld from Foundry will also be joining the board

- Gillian Muessig, my co-founder (and my mom), will be stepping down from the board of directors and resigning her title of President (more on that below)

- Both Gillian and I gave up some shares without compensation in this round in order to issue grants to current employees to protect them from dilution (also more on that below)

Following the transaction, here's how the ownership breakdown of SEOmoz looks (be sure to mentally place a ~ in front of numbers):

As part of this round, Gillian and I had initially planned two somewhat unique moves.

First, to take some "money off the table," meaning that we'd sell shares directly to the company and use some of the funding for personal capital. We had initially intended to have Gillian take ~$4mm and me take $1mm, but ran into a challenge around pricing. In order to fairly value "common" stock (which is what Gillian, myself and employees own), companies must undergo a 409A valuation by an external party. Ours came back valuing the common stock at $49mm (vs. $93mm for preferred). This low number is great for employee option grants and recruiting, but means that we'd be selling a lot of shares to reach those target numbers. Hence, we opted to take more minimal payouts now of ~$440,000 each, most of which is going into a fund for some family members' debt we've long wanted to pay off. In the future, we'll have the option to sell back more shares at future 409A valuation prices.

The second move is more non-standard. When a new employee joins a startup, they usually receive stock options equivalent to some percent of the company's total ownership (if you're interested in learning more, I recommend this post from Dan Shapiro and this one from Tony Wright on the topic). For example, let's say John joined SEOmoz in January 2012 and received 1,000 stock options and we have a total of 1,000,000 shares. John has options equivalent to 0.1% of the company. In a normal fundraising round, everyone takes some "dilution" to make room for the new investors. If the new investors own, say, 20% of the company in the funding round, John's options now represent 0.08%.

Gillian and I have always been passionate about three goals around SEOmoz:

- Make it easier for people to spread ideas on the web (first with consulting, then later through software and education)

- Create a role model company in Seattle that will inspire others in the startup and marketing ecosystems

- Mint a large number of new millionaires in the Seattle region through the value the company creates

Saying those are goals is one thing, but making tangible, visible moves to prove that commitment is harder. This is one of the few times we can show how serious we are about goal #3. Thus, we each sacrificed shares we owned to give back to each active employee at the company so they maintain their ownership percentage. In our example of John above, this would mean 0.02% of new stock options granted to him.

I'm incredibly grateful to Gillian for helping to make not just this transaction and stock sacrifice possible, but for all the amazing support and effort she's devoted to the the company over the last decade. For those who don't know, Gillian founded the business that eventually became SEOmoz in 1981! That's more than three decades ago. For the first two, she was the sole propietor. After 2001, when I dropped out of school, we joined forces with Gillian as President for the next 6 years. In 2007, after our funding transaction from Ignition, she stepped out of a day-to-day operational role to contribute as a full-time evangelist and member of our board of directors. Today, she takes another step toward pursuing new goals and aspirations.

Thousands of folks in the Moz community have met and interacted with Gillian over the last few years through her extensive world travels. I hope you'll join me in thanking her for the amazing work she's done and supporting her new, more independent direction.

Plans for the Months and Years Ahead

The few people I've told of this transaction before today almost always ask "what are you going to do with $20 million in the bank?!"

We do have some big plans, but we also want to be very cautious and deliberate with spending. Given our revenue and expenses run rate, this is a decent amount of operating capital, but it certainly doesn't give us the freedom to be reckless. Several items on our roadmap in the next 12-18 months include:

- Hire 12-15 new mozzers in roles across the company. We'll be posting those here and would love to have your help recruiting.

- Move offices, hopefully by January/February of 2013, to help accomodate a larger team.

- Grow Mozscape, our link graph, dramatically in both size and freshness. In April, we spent nearly $500K to keep things running. We have a lot of infrastructure and code investments to make to get better here. Short term, we're looking to have new indices close to 100 billion URLs every 2 weeks, then improve from there. Later today (possibly tomorrow) we'll be launching a new index (~150B URLs, almost 3X our previous record).

- Launch one very big, exciting new project we've been building since last year, hopefully in October or November of 2012, but possibly early 2013.

- Look into some potential acquisitions of companies/assets for technology, data, people and strategic considerations.

- Ramp up marketing, both on the inbound front and in paid channels.

- Invest in some research and content-focused projects across the field of inbound marketing - content, community, search, social, analytics and CRO. I'm looking forward to doing more work like our beginners' guide and ranking factors projects in each of these arenas.

If you have suggestions, we are, of course, all ears!

My sincere thanks and great big hugs go out to everyone in the Moz community, Seattle startup world and of course, our investors, new and old. We know that the road ahead will have more big challenges to overcome, but it's been so much more fun and rewarding taking this ride together. Here's to finally putting the psychological fear and disappointment of failed funding behind us and to an incredibly bright future.

p.s. If you have any questions related to this news, feel free to ask in the comments and I'll do my best to reply (am on my way to the Future of Web Insights conference in Vegas this afternoon, so please forgive if I'm a bit tardy).

![How To Drive More Conversions With Fewer Clicks [MozCon 2025 Speaker Series]](https://moz.rankious.com/_moz/images/blog/banners/Mozcon2025_SpeakerBlogHeader_1180x400_RebeccaJackson_London.png?w=580&h=196&auto=compress%2Cformat&fit=crop&dm=1750097440&s=296c25041fd58804005c686dfd07b9d1)

![How To Launch, Grow, and Scale a Community That Supports Your Brand [MozCon 2025 Speaker Series]](https://moz.rankious.com/_moz/images/blog/banners/Mozcon2025_SpeakerBlogHeader_1180x400_Areej-abuali_London.png?w=580&h=196&auto=compress%2Cformat&fit=crop&dm=1747732165&s=d887ee9e0e183cbb2bf4d61c717c2aa3)

Comments

Please keep your comments TAGFEE by following the community etiquette

Comments are closed. Got a burning question? Head to our Q&A section to start a new conversation.