8 Methods + Lots of Tools for Getting to Know Your Audience

Music to enjoy while reading this post: We Know Something You Don't Know by DJ Format & Jurassic 5

You provide something specific: That might be a product, a service, a trustworthy source of information, a community space… And you know exactly what your audiences may be searching for to find your wares. But do you know what they really want out of you? Do you know how they really feel? Do you know what they want more of or less of in your industry? Do you know what they like or don’t like on your site or your competitor’s sites? Do you know what they think about your new product launch? If you knew this information, how could you use it to improve your products or services?

In this post we’ll look at a few ways in which you can gather insightful information to help you position your brand against your competitors, laser target the specific desires of your audiences, and dive into the psyche of the people you want to attract and convert, categorized by what they want out of your industry, you, and your site.

WHAT DO YOUR AUDIENCES WANT OUT OF YOUR INDUSTRY?

Let’s say you’re in the online car insurance industry. You are considering what steps need to be taken to avoid search engine algo disasters and provide unique, compelling content and services that your audiences want. You’ve done your keyword research, so you know what search terms people are using, but what do they really want from your industry? Here’s some ways to find out.

1) Industry Market Research

You can typically find a wealth of market research by industry from sites like the ones listed below, although oftentimes this research is not cheap.

What to look for:

- Market demand

- Market trends

- Market entry

- Market issues/obstacles

- Statistical details for your target audiences

Sources:

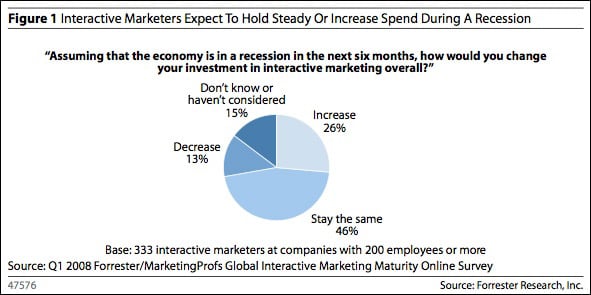

- eMarketer (paid reports + free articles)

- MarketResearch.com (paid reports)

- Forrester (paid + free reports)

- Hitwise (paid research + reports & webinars)

- Plunkett Research (paid reports)

- Valuation Resources (paid reports)

- International Business Strategies (paid reports)

- The Internet Time Machine (trend reporting software)

- Census.gov Statistical Abstract (US, Canada)

2) Social Industry Sentiment

Many people think of social media as a way to connect with your industry influencers and brand advocates. But social media data is also spectacular for simply passively gathering insights. There is a wealth of information online about your industry and how people feel about it, talk about it, interact with it, etc. This information can help you take a strategic approach at entering an industry, or refine your current positioning and offerings within an industry.

What to look for:

- Track industry terms as your topics, to find out what people are saying about the industry, what they want to see more of, what they don’t like or want to see less of, and potentially for spotting any industry trends through online conversations.

- Determine industry needs and sentiments in emerging markets before drawing up a product/service strategy.

Source A: Expensive, detailed (and mostly deep crawl) social media monitoring tools

There is still a major gap in social monitoring tools where the ones that provide the best crawl and interface for useful, actionable industry and/or brand health data can run you from $30,000/year to $30,000 month or more. For enterprise-level sites looking to harness conversations around the web, enterprise-level social monitoring solutions are the only answer (in this case, typically as an alternative or accompaniment to traditional survey-based brand health metrics). I’ve done audits on several of these solutions over the years and here are some worth looking into if you can throw the cash towards it.

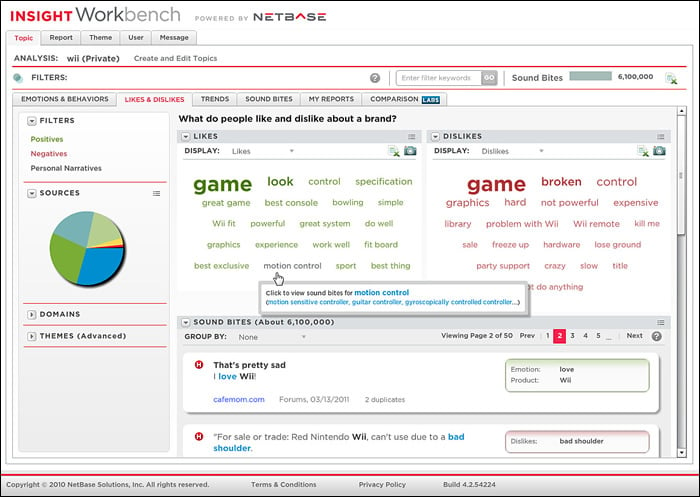

- NetBase – Still one of (if not the) best and most useful tools for brand sentiment I’ve seen yet. Competitive sentiment, competitive liked/disliked attributes, passion index, conversation drivers, etc.

- Dow Jones Insight – Flexible sentiment, regional trends, large coverage on- and offline, measures not just what happened, but also what was impact?

- Nielsen Online – LSI-type algorithm, feeling & tone metrics, measure by language + lots more.

- Visible Technologies – Subtopic identification, management tools, highly drillable, sortable data + more.

- Radian6 – Share of conversation, demographics, location, influence, Salesforce & WebTrends integration, lots of charts.

- Converseon - Uses a combination of text analytics, machine learning, and human analysts to provide sentiment analysis.

Source B: Free and cheapish (but often not very deep crawl) sentiment tools

I want to have more faith in “tools for the people”, but in most cases, I’ve found search engines (see next section) to be more useful in finding good sentiment data than any of the free/cheap tools (and sometimes even the expensive tools). Try the software out and compare the insights you find with what you find in the next section using search engines to make the decision on whether it might be worth shelling out $200-$3000/mo or more towards these sentiment research tools.

- Social Mention (free) – Sentiment, strength, passion & reach scores around a topic + top keywords, users, hashtags and sources.

- HowSociable (free) - Brand visibility score in several social networks.

- Trackur (paid) – Sentiment and influence metrics and tracking (history).

- eCairn (paid) – Share of voice, mind and/or topic + additional social media tools.

- Alterian SM2 (paid) – Share of voice, themes, demographics, sentiment analysis, etc.

- Trendrr (paid) – Sentiment analysis & influencer identification, location & demographic filters.

- Position2 (paid) - Share of voice, share of media, demographics, sentiment analysis, etc.

- And 195 more: http://www.salesrescueteam.com/social-media-measurement-tools/

Source C: Search Engines

If you don’t have a social listening tool or you’re just not getting good info from it, use the tool we all know and love: Search! Search engines still crawl much farther and deeper than most social media tools, so you can find more information if you know how to look. Search for any variation of things like:

- “like” + [your brand name]

- “love” + [a feature you provide]

- “I wish” + [a feature you provide]

- “sucks” + [an author or blogger on your site or your competitor sites]

- “hate” + [your competitors’ brand names or features]

Additionally, search Twitter, Facebook, YouTube, Yahoo! Answers or other social networks for the same type of information. I typically find the best feedback in this manner (using search + searching social networks), although it is more time consuming than the social media monitoring tools.

WHAT DO YOUR AUDIENCES WANT OUT OF YOU?

3) Social Brand Asset Sentiment

In addition to what people want out of your industry, it is important to know what people want out of you and your brand assets. Your brand assets could include your services, products, product features, executives at the company, editorial personalities, and the brand name in general.

What to Look for + Sources

Test brand asset topics out in the social media monitoring tools mentioned above (including search engines) to gather insights on what people around the web are saying about your brand. Each tool may provide different types of information, like:

- Positive and negative sentiment around brand assets and competitors

- Share of voice

- Specific likes and dislikes (deeper dig into sentiment)

- Campaign reach/brand visibility

- Localized share of voice and sentiment trends

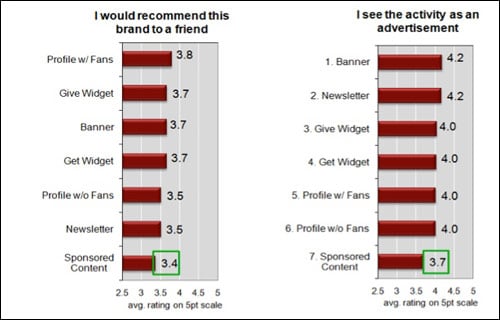

4) Traditional Brand Sentiment

These survey-based reports typically show similar types of insights as the expensive social monitoring tools, only they are derived from surveys rather than scraped from the web.

What to Look for

- Brand health

- Brand sentiment

- Brand awareness/share of voice

- Brand penetration

- CSAT (Customer Satisfaction)

- Same measurements online for competitor brands

Sources:

- Nielsen

- Synovate

- Forrester

WHAT DO YOUR AUDIENCES WANT OUT OF YOUR SITE?

Lastly, you’ll want to gather insights on the site experience that your audiences are having, and how it can be streamlined and improved. Don’t forget, search engines want to see sites that people find valuable, so make sure you’re doing what you can to attract your audiences and keep them engaged, as well as prompting the sharing of your content in social spaces.

5) Solicited Site Feedback

If you ask your visitors for feedback you can use that data as well. Although soliciting feedback is not as unobtrusive as just using your site analytics data to determine where there are problems, it may be useful in getting a more human response to the potential issues on your site. Consider small incentives in return for feedback, like discounts, being entered into a contest, access to survey results (when appropriate), or other types of special recognition.

Sources:

- GetSatisfaction

- Kampyle

- UserVoice

- On-site feedback surveys, collections or feedback forms

6) On-Site Search Queries

Looking at what people are searching for on your site, and what they are or aren’t finding, can be very useful site feedback. For sites with large databases like music or movies, site search may be the simplest way to get to the destination. See what is searched for the most to provide that content up front. For other sites, look at what people are searching for, which may be an indication of what they expect to find but can’t. Determine how your site can better meet those needs.

What to Look for:

- What people want or expect to find on the site.

- What people can’t find on the site.

- Searches on your site that return no results.

- Searches on your site that end in an exit rather than a click on search results.

Sources:

- Your own on-site search analytics platform.

7) Click-tracking & heat maps

These colorful displays are probably the coolest ways of gathering site feedback. Use these tools to determine whether people are seeing your most important content and calls to action on each page.

What to Look for:

- Are your primary calls to action getting clicks? Are they in view?

- Are you funneling visitors to the pages you want to?

- Are there links that are not getting any clicks?

- Is there content that isn’t getting eyeballs?

- What is the performance from search vs. the rest of the site?

Sources:

8) Focus Groups and User Groups

Set up some objectives for a focus group to try to accomplish with your site and watch how they try to get there, what obstacles they come across along the way, how they think and feel about the experience, and more. This can be useful feedback from people who are not familiar with the site the way you and your team that are building the site are.

What to Look for:

- How people feel towards planned new features or content

- Ways to improve existing features and content

- Whether your users want or need new features or content

- Whether there are features and content you can change, improve, or get rid of

- How people attempt to perform a task, and with what level of ease or difficulty

Sources:

- Search for focus group companies in your area.

- Do research on how to conduct your own focus group.

- Psychster (usability)

Have any additional methods or tools not listed here? Please share! :)

The author's views are entirely their own (excluding the unlikely event of hypnosis) and may not always reflect the views of Moz.

![Brand and SEO Sitting on a Tree: K-I-S-S-I-N-G [Mozcon 2025 Speaker Series]](https://moz.rankious.com/_moz/images/blog/banners/Mozcon2025_SpeakerBlogHeader_1180x400_LidiaInfante_London.png?w=580&h=196&auto=compress%2Cformat&fit=crop&dm=1749465874&s=df8aa6d34a976c4a941727c03aba118d)

![How To Launch, Grow, and Scale a Community That Supports Your Brand [MozCon 2025 Speaker Series]](https://moz.rankious.com/_moz/images/blog/banners/Mozcon2025_SpeakerBlogHeader_1180x400_Areej-abuali_London.png?w=580&h=196&auto=compress%2Cformat&fit=crop&dm=1747732165&s=d887ee9e0e183cbb2bf4d61c717c2aa3)

Comments

Please keep your comments TAGFEE by following the community etiquette

Comments are closed. Got a burning question? Head to our Q&A section to start a new conversation.